how to pay late excise tax online

THIS FEE IS NON-REFUNDABLE. Not just mailed postmarked on or before the due date.

Online Bill Payment Town Of Dartmouth Ma

You must have Signing.

. Online Payment Search Form. Under 359b Title 30 of the Delaware Code the Division is. Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor.

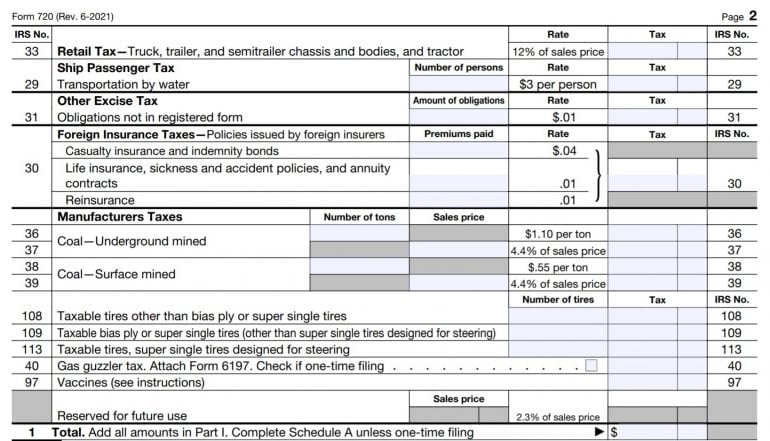

Ad Avalara excise tax solutions take the headache out of rate determination and compliance. This includes forms 720 2290 8849. A motor vehicle excise is due 30 days from the day its issued.

August 17 2016 - 113pm. 42496 IRC Section 6020 b. 424941 Penalties Applicable to Delinquent Returns Secured by Excise Examiners.

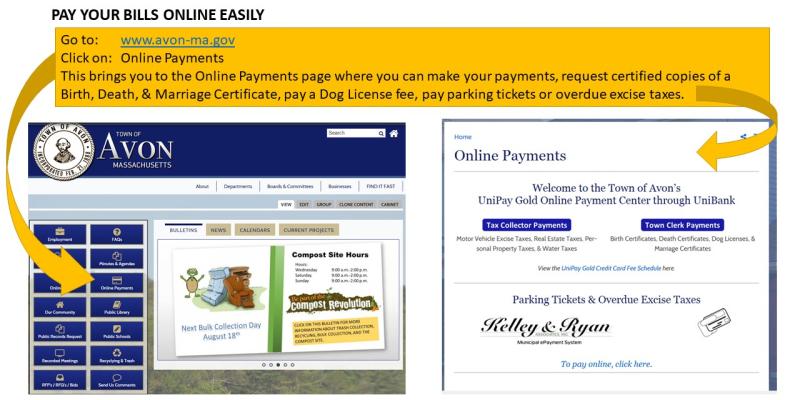

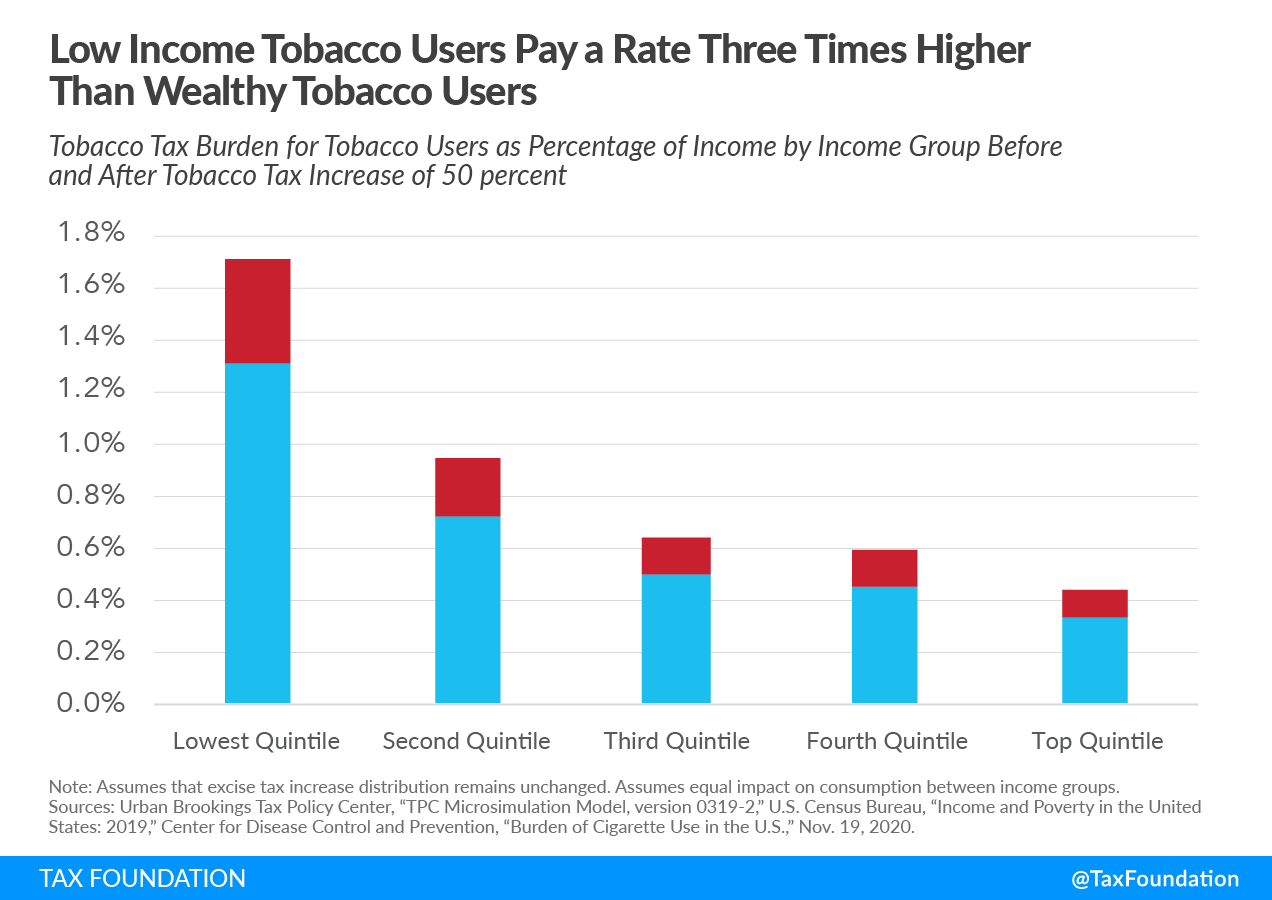

The tax is either ad valorem or specific. You can pay your excise tax through our online payment system. Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

You need to enter your last name and license plate number to find your bill. Filing frequencies due dates. Click here for details.

- Personal Property Taxes - Real Estate Taxes - School Department - Trash. The city or town where the vehicle is principally garaged levies the excise and. Convenience fees for paying excise taxes online.

Plan for and pay your taxes. Credit and Debit Cards. Payment at this point must be made through our Deputy Collector Kelley.

Tax classifications for common business activities. Please note all online payments will have a 45 processing fee added to your total due. 42495 Penalties Applicable to Substitutes For Return.

Avalara solutions can help you determine excise tax and sales tax with greater accuracy. What happens if you dont pay your. Under EASIEST the assessee is required to access the NSDL-EASIEST website httpscbec-easiestgovinEST and select the option E-Payment Excise Service Tax.

Our records indicate that the following taxpayers are currently not paying their State of Delaware tax liabilities. Massachusetts Property and Excise Taxes. Avalara solutions can help you determine excise tax and sales tax with greater accuracy.

Late returns or payments are subject to penalties and interest. The tax collector must have received the payment. There are two ways to calculate an excise tax.

Sequentially number your excise tax returns for the entire calendar year and start your serial numbers over at 01 at the beginning of each calendar year. - Delinquent Excise Taxes Flagged at. WE DO NOT ACCEPT.

Request for Tax Information. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. Log In Sign Up.

You must file an excise tax return. Such taxes may be imposed on the manufacturer retailer or consumer depending on the specific tax. Complete the Form BB-1 State of Hawaii Basic Business Application BB-1 Packet and pay a one-time 20 registration fee.

Logging in will give you access to eBilling AutoPay bill history and other features. Pay Delinquent Excise Parking Tickets Online - Kelley Ryan Deputy Collector. Go to our online system.

All Massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually. Use our penalty and interest calculator to determine late filing and late payment penalties and interest. Submit your report by logging in to your Alcohol Industry Management System AIMS account and looking for the File Excise Tax option on the dashboard for your business entity.

Additional fees may apply depending on which tax. Convenience Fees May Apply. Pay your outstanding obligations online by clicking on the Green area on the home page.

Excise tax return extensions. You need to enter your last name and license plate number to find your bill. PROCEED TO THE DEPUTY COLLECTOR SERVICE FOR.

You can pay your excise tax through our online payment system. Excise taxes are taxes that are imposed on various goods services and activities. Excise tax return extensions.

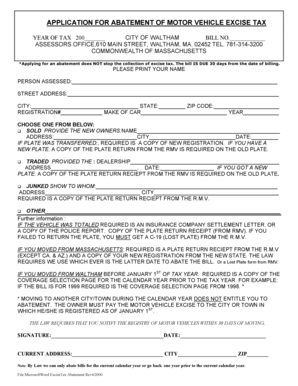

Fillable Online Application For Abatement Of Motor Vehicle Excise Tax Fax Email Print Pdffiller

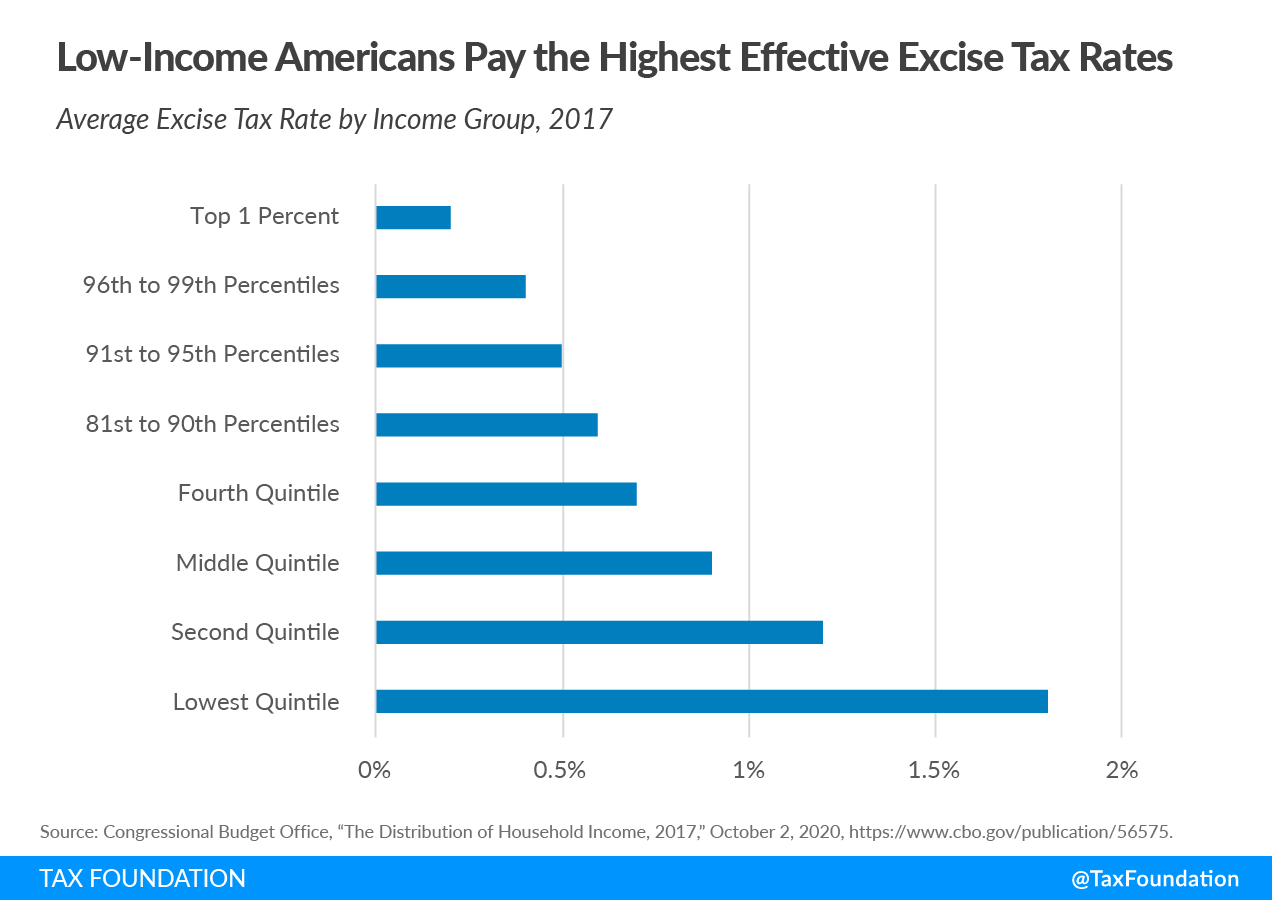

Excise Taxes Excise Tax Trends Tax Foundation

Online Payments Watertown Ma Official Website

Excise Tax The Ultimate Guide For Small Businesses Nerdwallet

Fuel Taxes In The United States Wikipedia

More States Strive To Tax Online Ads Despite The Challenges

Govconnectiowa Help Iowa Department Of Revenue

Motor Vehicle Excise Information Methuen Ma

Online Bill Payments City Of Revere Massachusetts

What Is Irs Form 720 Calculate Pay Excise Tax Nerdwallet

Massachusetts Used Car Sales Tax Fees

Online Banking To Pay For Town Bills Cohasset Ma

Motor Vehicle Excise Tax Bills Gardner Ma

Excise Taxes Excise Tax Trends Tax Foundation

How To Pay Your Motor Vehicle Excise Tax Boston Gov

What Is Eftps An Employer S Guide To The Electronic Federal Tax Payment System